Reckoning from Poitou, France...

Today commemorates the day when the Virgin rose to Heaven.

It is also marks the day when the world’s money system headed to Hell.

As to the first, Dear Readers need no reminder or instruction. Everyone knows about the Assomption of the Virgin, though no one we know seems to know how it happened, exactly, or what is the significance of it. Looking it up in our Petit Larousse, we find that it is a miracle of recent vintage, only established in 1950.

And now that we think of it, it seems unnecessary. Was there ever any doubt that the Virgin would go to Heaven? Why celebrate a victory that was in the bag from the get-go?

So, let us turn our attention to the second great thing that happened on this date...precisely 40 years ago. Here is a story with a cast of thousands – protagonists, antagonists, nihilists and monetarists! With dramatic tension up the wazoo. And who knows how it might turn out? Detlev Schlicter, writing in

The Wall Street Journal:

Forty years ago today, US President Richard Nixon closed the gold window and ushered in, for the first time in human history, a global system of unconstrained paper money under full control of the state.

Of course, we know exactly where we were and exactly what we were doing on that fateful day. We were watching television...

Richard Nixon, President of All the Americans, had something terribly important to say to his people. But he was worried. He summoned his advisors together and posed the key question to them:

“Should we interrupt

Bonanza?”

Bonanza was a very popular TV show, featuring a prosperous rancher, his three sons, and their Chinese cook. Since

Bonanza was much more popular than Richard Nixon, the president hesitated to interrupt it...even though he was going to change the entire world’s monetary system...and, in fact, institute a bold new system of purely-paper money.

In trials, run over the preceding two thousand years or so, this new system had always failed. But Richard Nixon seemed unaware. In fact, he seemed unaware that he was changing anything important at all...and didn’t even mention it to TV viewers that night.

Instead, he directed his attentions to another experiment in central economic planning – another one that also failed every previous test – wage and price controls. Taking a page out of Emperor Diocletian’s book on “How to Screw Up an Economy,” Nixon announced that henceforth the authorities in Washington would decide how much a man should pay for a loaf of bread or how much his employer should pay him for his labors.

Naturally, this effort was a failure too...and was quickly forgotten. But Nixon’s other initiative stuck. The world has suffered from it ever since. We are 4 decades into this latest experiment with paper money – the most successful effort so far; no doubt about it. People still use dollars with few complaints. Butchers take them in exchange for meat. Prostitutes take them in exchange for services rendered. Politicians take them in exchange for votes.

As far as we know, nobody doesn’t want them. As far as we know nobody will not want them tomorrow either.

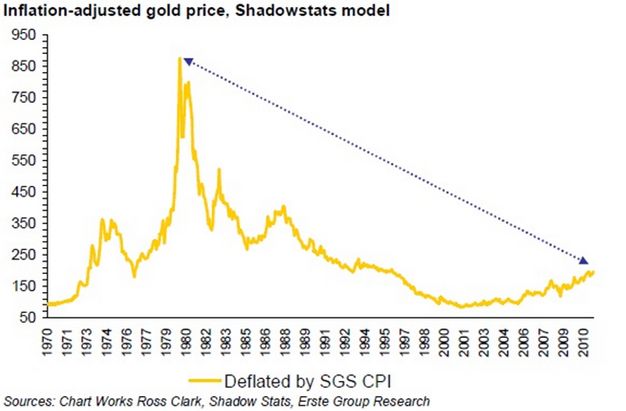

But wait, while dollars are universally accepted as a medium of exchange, as a store of value – money’s other purpose – green paper has been a flop. It began losing value immediately after the Federal Reserve was set up to protect it. And then, when President Nixon cut the dollar’s last connection to gold, it lost value even faster. Today, a dollar will buy only about a penny or two as much as a dollar from 1913.

And people are beginning to wonder. What’s wrong with the world’s financial system? How come so many economies – the US in particular – are in such a funk? And what or who is to blame? Could Richard Nixon’s new ‘funny money’ have something to do with it?

That answer, as long-time

Daily Reckoning sufferers know, is ‘yes.’

And more thoughts...

What a week!

Last week ended in a state of calm. After heavy shelling and a murderous cross-fire all week, the Dow rose 125 points on Friday. The 10-year T-note yielded 2.25%. And gold fell $8...after hitting a record of $1,800 earlier in the week.

Whew!

At a party last night, we were asked what we did for a living.

Not having a simple explanation we resorted to a simple lie.

“I’m an economist and a writer.”

Well, it was only half a lie. The economist part.

It turned out, we were sitting next to a woman with a Ph.D. in economics...and a man who taught economics at a university in Belgium. Unfortunately, it was a loud room, with about 50 different conversations going on at once, and the professor from Belgium had an accent with which we were unfamiliar, so we didn’t understand him as clearly as we would have liked.

Still...a lively conversation ensued...

“Well, you must be happy. You have so much to write about!”

“Yes...”

“But what can you say? The system is a mess. But how often can you say that?”

“Every day.”

“Oh...don’t your readers get tired of hearing the same thing?”

“Yes.”

“Oh my...perhaps you should become a juggler or an astronaut, or something.”

“Yes...”

“But seriously...this is a big problem. What can you do? The banks are insolvent because they lent to developers, who are insolvent...and governments are going broke because they are trying to keep the banks from going broke.

“And that is in Europe...in America it is worse, because households are broke too...just as they are in Ireland...

“The whole system is a terrible mess. But I see three different approaches evolving. The developing countries are booming...and they’re going to continue. They need to catch up. Sure, they will experience their own busts and blow ups...but they are basically societies where there are a lot of people working hard to increase their standards of living. They are young. They are dynamic. They want more wealth.

“Europe is different. People don’t really care much about increasing their standards of living. They want to live better. That’s why they are so obsessed by the environment, for example. And their sausages. And their vacations. They want more free time. They want better views and better food.

“They don’t really care about being richer...not in a traditional sense.

“And Americans? They are the hardest to figure out. They are too busy. They worry me. They work hard but don’t get anywhere. And they don’t really have time to think about it. So, they end up doing silly things... You could look at US foreign policy that way. Trillions of dollars spent, for what? They never took the time to really think about it...

“Anyway, I think that is the way most Europeans see it. The Americans are so busy...and so naïve. They don’t have time for much reflection. They are people of action. Not people of thoughtfulness or reflection. So they tend to act without really considering what they are doing or why they are doing it.

“Don’t get me wrong... I know you’re an American...and I love America too... My husband and I spent several years in New York. We loved it. And we traveled all over the country. They were the happiest years of our lives, in many ways.

“But I do notice a dark trend in America... People are too busy. They are barely keeping up with their bills. They seem to be more and more desperate...looking for a simple solution. But there’s no simple, painless solution. That’s the problem of debt. There’s no painless way out.

“We all seem to be following in Japan’s footsteps in that regard. At least in the developed world. Here in Europe, people don’t seem to mind. In America, I don’t think it will go over so well.”

Regards,

Bill Bonner,

for

The Daily Reckoning

You should let the video footage of the wild violence that just took place in London burn into your memory because the same things are going to be happening all over the United States as the economy continues to crumble. We have raised an entire generation of young people with an “entitlement mentality”, but now the economy is producing very few good jobs that will actually enable our young people to work for what they feel they are entitled to. If you are under 30 in America today, things look really bleak. The vast majority of the good jobs are held by people that are older, and they aren’t about to give them up if they can help it. It is easy for the rest of us to tell young Americans to “take whatever they can”, but the reality is that there is intense competition for even the most basic jobs. For instance, McDonald’s recently held a “

You should let the video footage of the wild violence that just took place in London burn into your memory because the same things are going to be happening all over the United States as the economy continues to crumble. We have raised an entire generation of young people with an “entitlement mentality”, but now the economy is producing very few good jobs that will actually enable our young people to work for what they feel they are entitled to. If you are under 30 in America today, things look really bleak. The vast majority of the good jobs are held by people that are older, and they aren’t about to give them up if they can help it. It is easy for the rest of us to tell young Americans to “take whatever they can”, but the reality is that there is intense competition for even the most basic jobs. For instance, McDonald’s recently held a “